-

The New York Board of Trade, exclusive futures and options exchange for the Reuters CRB

Index, will introduce new contracts on a revised and renamed version of this leading

benchmark of the commodity futures market beginning July 11, 2005.

The renamed Index – the Reuters/Jefferies CRB Index – is the collaborative effort of

Reuters, the global information company, and Jefferies Financial Products, LLC, a

leading provider of commodity-related products for institutional investors and a

subsidiary of Jefferies Group, Inc. On June 20, 2005 , the Index will officially become

the “RJ/CRB”, undergoing the most significant revision in its nearly fifty year history

with changes in weighting, methodology and commodity representation.

Developed in 1957, the Reuters/Jefferies CRB Index is one of the most often cited

indicators of overall commodity prices. Originally, the CRB Index was weighted heavily

towards agricultural commodities. Since its inception, it has been revised nine times to

be more representative of a broader range of commodity prices, particularly energy. This

tenth change brings the Reuters/Jefferies CRB in line with the evolution of a rapidly

expanding commodity futures market. The RJ/CRB Index continues to offer investors a

broad and reliable benchmark for the performance of the commodity sector; it now

represents nineteen commodity futures markets, including all five of the NYBOT primary

agricultural products (cocoa, coffee, cotton, FCOJ and sugar).

“The transition to the Reuters/Jefferies CRB Index comes at a significant time for

the futures industry,” stated NYBOT President and CEO C. Harry Falk. “Many portfolio

managers and individual investors are turning to commodities as an important alternative

asset class that may provide critical portfolio diversification, and the RJ/CRB market

at the New York Board of Trade offers serious investors access to the commodities market

though a single financial instrument with less volatility than generally found in many

individual commodities.”

New York ’s original futures exchange began trading the CRB in its index marketplace

in 1986; the name of the index changed to the Reuters CRB Index in 2001. Now again

renamed as the Reuters/Jefferies CRB Index, these contracts offer investors direct

access to an asset class that may diversify their holdings, improve portfolio returns,

reduce overall portfolio risk and hedge against inflation.

Trading in the RJ/CRB will commence on July 11, with the first listed month of

September 2005. Effective with this introduction, the RJ/CRB futures will list four

months on a quarterly cycle (March, June, September and December). The RJ/CRB contract

will also feature a multiplier of $200 times the Index (down from $500 in the old CRB).

The new contract size will provide easier access to the Index market. Real time data for

the RJ/CRB will be generally available beginning June 20 th under the current CRB

trading symbols.

The previous version of the Reuters CRB will be renamed the “Continuous Commodity

Index” and will be made available for trading under the symbol “CI” after the close of

business on June 17th. All outstanding open positions in the current Index will be

rolled into the new product and trade under the symbol “CR”. The Exchange will continue

to list new months for the CCI.

-

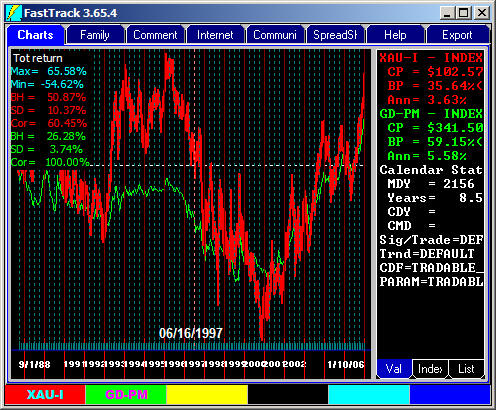

CRB-1 Reuters CRB Total Return Index

For FastTrackers the CRBI- and CRB-1 offer the opptunity for generating

simple relative strength signals. Using CRBI- in red and CRB-1 in green,

AccuTrack 25/100 creates signals which have a successful timing record. This

is by no means optimal. However, the strategy suggests potential for using

these signals to trade short/long commodity funds to diversity a portfolio.

http://www.crbtrader.com/crbindex/total_return.asp

"The Reuters-CRB-Tot Return Index's (CRB-1) return and volatility

characteristics allow it to serve as an benchmark for institutions looking to take advantage of

this asset class.

One of the key features of the CRB-1 is its method of calculation. Because the CRB-1 is

geometrically averaged, the listed CRB-1 future contracts almost always trade at a discount to

their fair value. This is due to the fact that arbitrageurs are able to manage a short CRB-1

futures position against an equal weighted long component position which is arithmetically

weighted. As time passes and depending upon the volatility of the component commodities, the

arbitrageurs long component position will outperform the short CRB-1 position. This mathematical

certainty allows the arbitrageurs to sell CRB-1 futures contracts at a slight discount to their

daily calculated value. Informed investors may regularly obtain this price anomaly and therefore

increase their overall return by the level of the discount captured. A large institutional

investor may find this aspect of using the CRB-1 particularly attractive. Along with the size of

a CRB-1 futures contract ($100,000 per contract with the index at 200.00), using CRB-1 futures

contracts may seem the most useful of the current commodity benchmarks currently available.

Many investors looking to commodities as a hedge against other held assets are not so much

concerned with commodity prices rising but with commodities prices rising quickly. Large

upward spikes in commodity prices may send investors scrambling to insulate their portfolio

against the possible inflationary ramifications associated with such a move. The comparatively

low volatility of the CRB-1 make using CRB-1 options a reasonably priced insurance policy.

"

For every exchange traded fund there is an index. These are members of

the FastTrack ETFIndex family. Trades in the ETFs during the trading

day occur above

and below the most recent index number typically taking place with 0.1%

-.25% of the index. Strategy: The index-ETF spread is always

most narrow at the close of the market which, not coincidentally, is the

only time at which the exchanges are required report trading spread. End of

Day trades are usually batched together and executed 15-minutes after the

close of the US markets. When buys and sells are in balance the average

closing trade is very, very close to the index close.

Major organizations like Dow Jones and Barclay's Bank have

longstanding indexes and create new indexes regularly in hopes of attracting

license fees from organizations who wish to create new ETFs based on the

indexes. Often, but not always, when a new ETF begins to trade, the index

organization will publish a new version of the index with a different ticker

symbol to underlay the ETF. Often a longstanding index has been (and will

continue to be) be computed or managed in way that is difficult for a funds

manager to follow. The new equivalent ETF index, using a different set of

construction rules, is intended to be easier to manage.

This new index ticker and associated data will coexist with the old

index ticker

symbol both often having the same name and essentially the same performance.

FastTrack often carries both of these indexes and the longstanding index

will have much more data and be more widely recognized.

Federal Reserve

These indexes and many more will be added to the IndexFam by 11/5/2018

See the online discussion of each of these indexes

The majority of gold by weight is sold in the London markets at the morning and afternoon

gold fix price - one price for all trades. These are the prices we quote in GD-AM and GD-PM.

This means that NY prices can differ (as they do in the 13 cities worldwide that trade

gold). In the US Handy Harmon Index (Bridgeport CT) , is commonly used. The HH price adjusts to

the London Afternoon gold fix and then can drift from that point later in the NY trading day.

One issue created by our use of the London pricing is that London trading is closed for

different holidays. Where we do not get

a London price for a US market day, then FastTrack's GD-PM will be adjusted to match the HH

price quoted in the Wall Street Journal. Commonly, the quoted HH Price is the same as the

London PM fix, but not always.

XAU-I is an index of gold stocks. This index is often used as a basis for trading of

derivatives (options and futures). Gold stocks are more volatile than the price of gold, and

generally move in the same direction as the underlying price of gold. A small increase in gold

price can result in the doubling of profits in the gold stocks.

LIBOR licensed from Intercontinental Exchange is a

benchmark rate the world's leading banks use to charge each other and

to base interest rates for consumers..

LIBOR Indexes

BL12-

EL12-

ZL12-

UL12-

BL1-

EL1-

ZL1-

UL1-

BL1W-

EL1W-

UL1W-

BL2-

EL2-

ZL2-

UL2-

BL3-

EL3-

ZL3-

UL3-

BL6-

EL6-

ZL6-

UL6-

|

12-M LIBOR-British Pound

12-M LIBOR-Euro

12-M LIBOR-Swiss Franc

12-M LIBOR-US Dollar

1-M LIBOR-British Pound

1-M LIBOR-Euro

1-M LIBOR-Swiss Franc

1-M LIBOR-US Dollar

1-W LIBOR-British Pound

1-W LIBOR-Euro

1-W LIBOR-US Dollar

2-M LIBOR-British Pound

2-M LIBOR-Euro

2-M LIBOR-Swiss Franc

2-M LIBOR-US Dollar

3-M LIBOR-British Pound

3-M LIBOR-Euro

3-M LIBOR-Swiss Franc

3-M LIBOR-US Dollar

6-M LIBOR-British Pound

6-M LIBOR-Euro

6-M LIBOR-Swiss Franc

6-M LIBOR-US Dollar

|

See details at

https://www.investopedia.com/terms/l/libor.aspand

inflation |

Bank of America Bond indexes

Licensed from Intercontinental Exchange

E3CE-

E3C6-

E3C-

E3CT-

M9TR-

M5TR-

MFTR-

M6TR-

M7TR-

M1TR-

M2TR-

M3TR-

M4TR-

MMTR-

M9EY-

M9OA-

M96Y-

M5EY-

M5OA-

M56Y-

MFEY-

MFOA-

MF6Y-

M6EY-

M6OA-

M66Y-

M7EY-

M7OA-

M76Y-

M8EY-

M8OA-

M86Y-

M8TR-

M1EY-

M1OA-

M16Y-

M2EY-

M2OA-

M26Y-

M3EY-

M3OA-

M36Y-

M4EY-

M4OA-

M46Y-

MMEY-

MMOA-

MM6Y-

|

BofAML AAA-A Emerging Markets Corporate

BofAML AAA-A Emerging Markets Corporate

BofAML AAA-A Emerging Markets Corporate

BofAML AAA-A Emerging Markets Corporate

BofAML US Corp 10-15yr Total Return Inde

BofAML US Corp 1-3yr Total Return Index

BofAML US Corp 15yr Total Return Index V

BofAML US Corp 3-5yr Total Return Index

BofAML US Corp 5-7yr Total Return Index

BofAML US Corp A Total Return Index Valu

BofAML US Corp AA Total Return Index Val

BofAML US Corp AAA Total Return Index Va

BofAML US Corp BBB Total Return Index Va

BofAML US Corp Master Total Return Index

BofAML US Corporate 10-15 Year Effective

BofAML US Corporate 10-15 Year Option-Ad

BofAML US Corporate 10-15 Year Semi-Annu

BofAML US Corporate 1-3 Year Effective Y

BofAML US Corporate 1-3 Year Option-Adju

BofAML US Corporate 1-3 Year Semi-Annual

BofAML US Corporate 15 Year Effective Yi

BofAML US Corporate 15 Year Option-Adjus

BofAML US Corporate 15 Year Semi-Annual

BofAML US Corporate 3-5 Year Effective Y

BofAML US Corporate 3-5 Year Option-Adju

BofAML US Corporate 3-5 Year Semi-Annual

BofAML US Corporate 5-7 Year Effective Y

BofAML US Corporate 5-7 Year Option-Adju

BofAML US Corporate 5-7 Year Semi-Annual

BofAML US Corporate 7-10 Year Effective

BofAML US Corporate 7-10 Year Option-Adj

BofAML US Corporate 7-10 Year Semi-Annua

BofAML US Corporate 7-10yr Total Return

BofAML US Corporate A Effective Yield

BofAML US Corporate A Option-Adjusted Sp

BofAML US Corporate A Semi-Annual Yield

BofAML US Corporate AA Effective Yield

BofAML US Corporate AA Option-Adjusted S

BofAML US Corporate AA Semi-Annual Yield

BofAML US Corporate AAA Effective Yield

BofAML US Corporate AAA Option-Adjusted

BofAML US Corporate AAA Semi-Annual Yiel

BofAML US Corporate BBB Effective Yield

BofAML US Corporate BBB Option-Adjusted

BofAML US Corporate BBB Semi-Annual Yiel

BofAML US Corporate Master Effective Yie

BofAML US Corporate Master Option-Adjust

BofAML US Corporate Master Semi-Annual Y

|

The purple is is a dividend adjusted line. The other lines are yield

rates For details see

https://fred.stlouisfed.org/categories/32413 |

|

https://fred.stlouisfed.org/categories/32413 |

VT10-CBOE 10-Year Treasury Note

Volati

VBR- CBOE Brazil ETF Volatility Index

VCN- CBOE China ETF Volatility Index

VCO- CBOE Crude Oil ETF Volatility Ind

VDJ- CBOE DJIA Volatility Index

VEM- CBOE Emerging Markets ETF Volatil

VE- CBOE Energy Sector ETF Volatility

XEC- CBOE EuroCurrency ETF Volatility

XG- CBOE Gold ETF Volatility Index

VGM- CBOE Gold Miners ETF Volatility I

VN100 CBOE NASDAQ 100 Volatility Index

VR2K-CBOE Russell 2000 Volatility Inde

VXO- CBOE S&P 100 Volatility Index: VX

VSP3-CBOE S&P 500 3-Month Volatility I

VAG- CBOE Silver ETF Volatility Index

VIX- CBOE Volatility Index: VIX

Moody's Bond Indexes

The Moody's bond index series available to us is listed below.

We license these these indexes using the ticker symbols shown. The indexes which

are not in FT DT DB as of August 2009 are included in this listing to give

you a better idea of the components of each index. No further explanation of

index components is available. We will add additional on request

-

MD-09 MOODY'S BOND YIELD AVG AAA RATED CORP

-

MD-16 MOODY'S BOND YIELD AVG COMP CORP

-

MD-18 MOODY'S BOND YIELD AVG COMP PUB UTIL

-

MD-21 MOODY's BOND YIELD US GOV 6-MO SECUR

Under Construction |

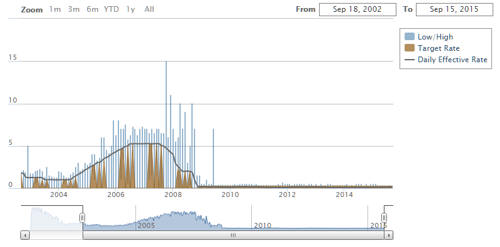

Federal

Funds Target Rate

Federal

Funds Target Rate